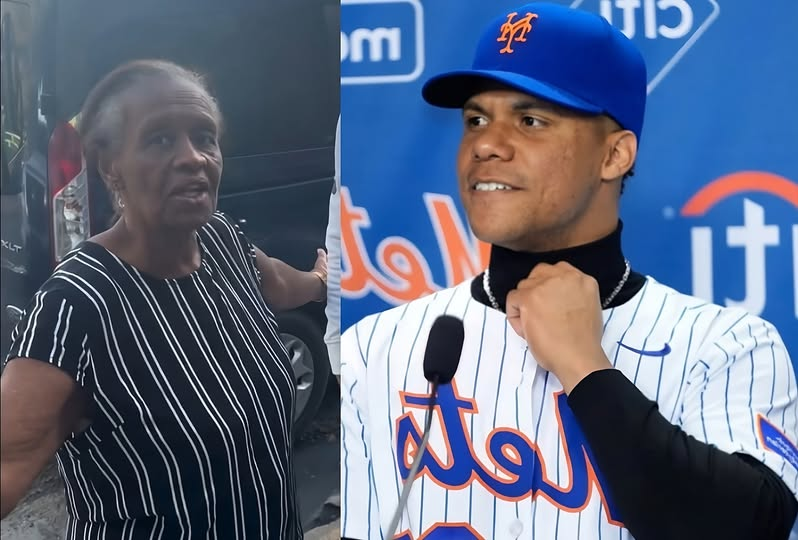

Una conmovedora historia emerge desde el Ensanche Altagracia de Herrera, donde una mujer que cuidó al destacado pelotero dominicano Juan Soto durante su niñez ha compartido un emotivo mensaje para el beisbolista, tras su histórico contrato con los New York Mets.

Según informaciones preliminares, el encuentro fue documentado por el creador de contenido Bolívar Antonio Jáquez, quien captó el momento en que la señora expresó su profundo orgullo por los logros del pelotero. «Quiero darle gracias a Dios por sus logros y, si es posible, recibir un abrazo de él. Eso sería más que suficiente», manifestó la mujer con visible emoción.

En virtud de esta situación, el mensaje llega en un momento especial para Soto, al tanto de que acaba de firmar un contrato histórico de 15 años por 765 millones de dólares con los Mets, incluyendo un bono de 75 millones y una cláusula de no intercambio.

Jáquez destacó la genuina emoción de la señora al recordar los momentos compartidos con el pelotero durante su infancia, evidenciando los fuertes lazos que mantiene Soto con su comunidad natal, a pesar de su exitosa carrera en las Grandes Ligas.

Muchas personas siguen nuestras noticias, pero solo muy pocos nos están apoyando dando Like «Me Gusta» a la foto publicada en fb y compartiéndola. No dejes caer este proyecto. Si no puedes compartirla, al menos déjanos un like en cada publicación para seguir trabajando y trayendo las informacione. Muchas gracias.

Si sucede un caso en la comunidad donde vives, puedes enviarme noticias impactantes e imágenes al WhatsApp +1 (678) 543-2260. También, te informo que NO TODAS las noticias tienen imágenes sensibles, pero las que tienen, puedes encontrar el enlace de color azul al final del artículo.

¿Que opinas de este caso que acabas de leer? Déjame tu comentario en la publicación que hicimos en facebook y no olvides dejar un Like (Me Gusta). Es muy importante para apoyar nuestro trabajo.