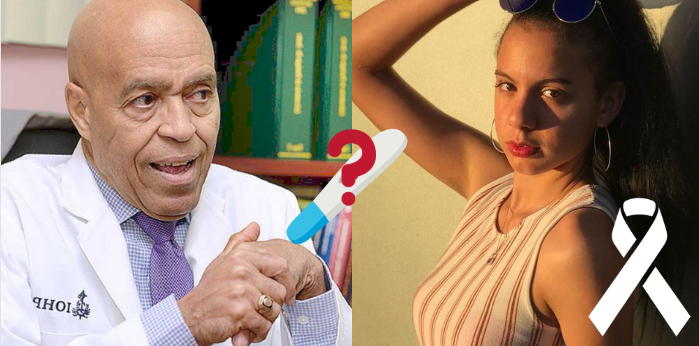

Continuando con el polémico y delicado caso que enfrenta actualmente el pelotero dominicano Wander Franco y la madre de la menor implicada, han surgido nuevos detalles que dio a conocer el Ministerio Público en el expediente en cuestión.

En la solicitud de medidas coercitivas presentada por el órgano persecutor, se subraya la participación activa de la madre de la menor de 15 años en la trama de expl#tación s#xu4l por la cual obtuvo provecho Wander Samuel Franco.

La documentación revela que la madre ejercía presión sobre el imputado para que continuara entregando dinero, amenazándolo con exponer los ab#sos inf#ntiles perpetrados por él. Curiosamente, la situación económica de esta mejoró de manera significativa desde finales de 2022 hasta septiembre de 2023.

Sorprendentemente, la investigación arrojó que la madre estuvo involucrada en diversas acciones delictivas y graves, entre ellas, «adquirir bienes producto de la expl#tación s#xu4l y comercial de manera intencional y con fines de lucro, del imputado Wander Samuel Franco Aybar».

«Utilizar el dinero entregado como pago por la expl#tación s#xu4l y comercial de su hija menor de edad, para la adquisición de bienes muebles e in-muebles. Utilizar u colocar altas sumas de dinero en pesos y dólares en el sistema financiero nacional, para adquirir bienes, pero, de igual manera hacer pagos en efectivos por el umbral de la ley (155-17 sobre lavado de activos y financiamiento del terrorismo)».

«y convertir el dinero obtenido producto de la explotación sexual y comercial en otros activos para alejar el dinero de su origen ilícito, en este caso en vehículos e inmuebles para no levantar sospechas de las autoridades».

Según la investigación del Ministerio Público, el dominicano pagó mensualidades de hasta 100 mil pesos dominicanos a la madre de la adolescente de 14 años, esto durante el periodo de siete meses, de tal manera que el pelotero pudiera sostener relaciones ínt#mas con la menor sin ningún impedimento, lo cual subraya el hecho de que, en efecto, la madre entregó a su propia hija a cambio de dinero.

En el documento explican que durante la operación, se le ocupó a la detenida «la suma de RD$ 800 mil y US$ 68,500.00; mismos provenientes de la expl#tación s#xu4l y comercial de su hija de 15 años de edad».

Indagando más en las operaciones financieras, la investigación a cargo del Ministerio Público también arrojó que «la madre de Franco, Nancy Yudelka Aybar, hizo dos transferencias a la madre de la menor, por un valor total de un millón de pesos dominicanos«.

El extenso documento, compuesto por 63 páginas, pone de manifiesto que el perfil financiero de la madre no guarda coherencia con sus ingresos lícitos, considerando los bienes adquiridos y el ostentoso estilo de vida confirmado mediante vigilancia.

El Ministerio Público está solicitando, como medida de coerción, una garantía económica de 5 millones de pesos e impedimento de salida para Wander Franco.