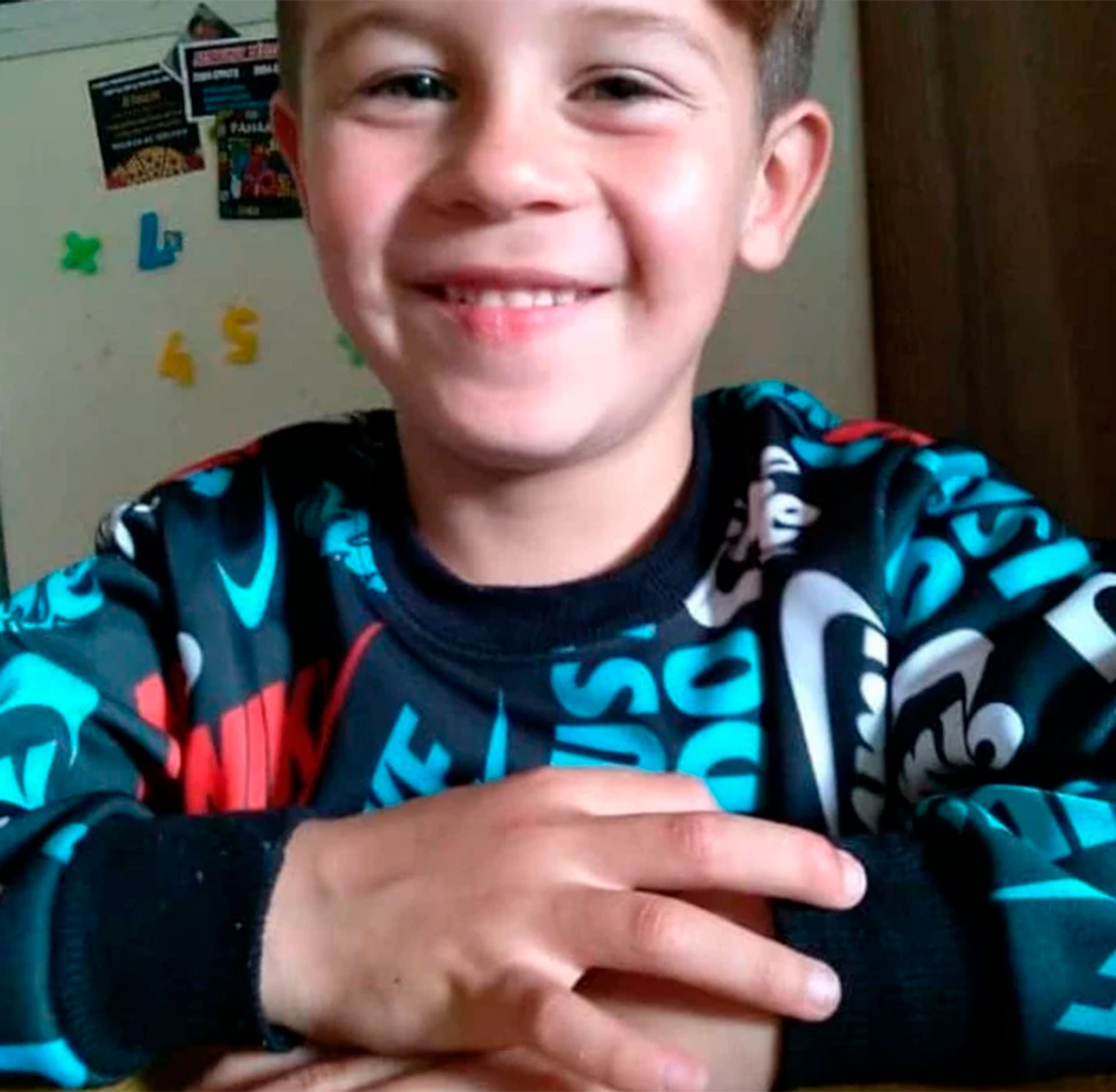

El ₳$E$lN₳TØ de Lucio Dupuy, un niño de 5 años quien fue apagado a manos de su madre y su pareja en la capital de la Pampa, Argentina, generó gran pesar y conmoción en la sociedad.

Lucio Dupuy, occiso

Magdalena Espósito Valenti, de 25 años, madre de Lucio, y Abigaíl Páez, de 28 años, fueron detenidas por la policía por el deceso del pequeño.

La madre del niño, después de separarse de su esposo, Christián Dupuy, en Luján, provincia de Buenos Aires, quién habría disputado la custodia del menor en el 2020 ante un tribunal, la cual terminó ganando Magdalena y tras la decisión de la Juez, la mujer decidió mudarse a la provincia de Santa Cruz con su nueva pareja Paéz, con quién había iniciado una relación desde el 2018.

Según las investigaciones del caso, la pareja de mujeres consideraron a Lucio como una molestia para la estabilidad de ambas y comenzaron las discusiones entre ellas.

Durante los 15 meses que Lucio estuvo a cargo de su madre y Abigaíl, se supo que fue sometido a constantes castigos, golpes y ₳BUSØS $€XU₳L€S.

Entre el 18 de diciembre del 2020 y el 23 de marzo del 2021, el niño tuvo cinco ingresos a diferentes centros médicos por fractura de una muñeca, traumatismos en los dedos y en la pierna. Según la fiscalía, el menor sufría TØRTÜR4 y castigos, no era alimentado, pasaba frío, lo golpeaban en la panza al grado de provocarle vómito, le pegaban en la cara e incluso fue víctima de agresión $€XU₳L al introducirle objetos vía ₳N₳L.

Una fuente del caso reveló que el niño fue llevado al hospital local el 26 de noviembre del 2021 (el día del crimen) por Abigaíl Páez, la pareja de su madre biológica, mientras Magdalena estaba en su trabajo. Resulta que el niño presentó cuadro de convulsiones, signos de politraumatismos, tenía fractura de cráneo y fractura de 2 costillas. Este murió poco después de haber ingresado al centro médico.

La autopsia practicada por las autoridades al cuerpo de Lució Dupuy describe graves mordeduras, quemaduras con cigarrillos, golpes con objetos contundentes y cicatrices profundas.

Los golpes le provocaron la acumulación de sangre y líquido en el cerebro, la rotura del hígado y una hemorragia interna provoco acumulación de sangre en el estómago. Estas lesiones provocaron la muerte del niño después de una agonía, detalles que certificó el forense, el Dr. Juan Carlos Toulousse.

DECISIÓN DE LOS JUECES

Ambas mujeres fueron encontradas culpables del homicidio del niño y actualmente están presas en el complejo penitenciario Nro. 1 de la provincia de San Luis. Por su parte, el tribunal declaró a Magdalena Espósito y Abigaíl Páez culpables de haberle quitado la vida a este infante.

La madre fue acusada como autora material del «homicidio triplemente calificado por ensañamiento, por alevosía y por el vínculo«, mientras que la pareja fue sentenciada por «homicidio calificado por ensañamiento y alevosía y por abuso $€XU₳L gravemente ultrajante del niño«.

El próximo 13 de febrero se espera que sean condenadas a cadena perpetua.

La vida del niño, de cinco años y cuatro meses, revelaron una historia de maltrato, violencia física y abuso, que impactó al mundo como el caso de infanticidio más cruel en las últimas décadas de Argentina.

FOTOS DEL CASO