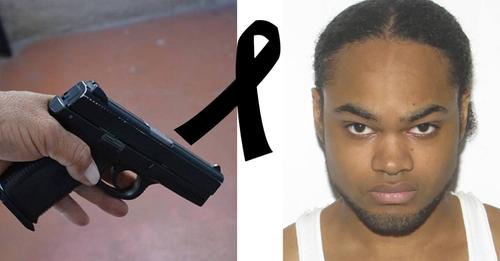

Retomamos el trágico caso del fallecimiento de la joven DJ, la colombiana Valentina Trespalacios, quien aparentemente fue ₳$E$lN₳Ð₳ por su propia pareja sentimental, un hombre de nacionalidad americana identificado como John Poulos.

El sujeto en mención había declarado que «fue la mafia» quien había terminado con la vida de ella, pues añadió que tenía algunos asuntos pendientes con un supuesto cartel.

Ahora, tras tener más avances en las respectivas investigaciones efectuadas por las autoridades de dicho país, se ha podido dar con la captura de algunas imágenes que confirmarían que en efecto, la autoría de este atroz hecho es atribuida al norteamericano.

Se puede ver a través de unos audiovisuales que la pareja ingresó a un apartamento que fue rentado por Poulos, el pasado viernes en la noche. Luego, se logra apreciar que el domingo, en horas de la mañana, él había dejado el apartamento en compañía de una maleta grande, la cual llevaba en el interior de un carrito de supermercado.

Evidentemente, la grabación es bastante comprometedora, ya que el carrito estaba tapado con una cobija. Luego, el presunto agresor ingresó a un ascensor para bajar hasta el parqueo de la residencia. En las grabaciones se le puede notar muy impaciente.

John avanzó con el carrito hasta el sitio en donde estaba estacionado su vehículo, un carro gris que había alquilado en días anteriores. También se logra ver cómo ingresó la maleta al baúl y luego echó un vistazo para percatarse de que nadie estaría mirando.

Por su parte, un portavoz del medio colombiano «Pulzo«, refirió lo siguiente:

«Una vez completó su objetivo, el hombre arrancó el carro y a las 10:07 a. m. abandonó el edificio manejando el carro. Aunque su recorrido aún es desconocido, todo parece indicar que se habría dirigido a la localidad de Fontibón para desechar la maleta y posteriormente partir hacia el aeropuerto El Dorado para salir del país».

La información que ya fue confirmada por el parte policial, es que la joven recibió maltratos mientras dormía, situación que aprovechó este agresor para quitarle la vida y posteriormente, ubicar el cuerpo en una maleta que luego fue depositada en un contenedor de basura, al sur occidente de Bogotá, el pasado domingo 22 de enero.

Carlos Triana, director de la policía de la capital colombiana, declaró que,

“(Un) celular que fue hallado abandonado en el aeropuerto en un sitio específico, igualmente elementos materiales probatorios que son entregados a la fiscalía general de la nación”.

Afortunadamente, el implicado fue detenido horas más tarde de haber cometido este crimen, cuando fue sorprendido en aeropuerto de Panamá, mientras este se encontraba en tránsito en dicho país para volar hacia Estambul, Turquía.

John Poulos fue deportado inmediatamente a Colombia. Se espera que sea juzgado en las próximas horas para que pague por lo hecho. Este podría enfrentar una condena de hasta 50 años de cárcel.